Hello friends, this time I will provide

information on a project related to the global lending market that gives

investors access to alternative lending asset classes, the name of the project

itself is Pngme. With the support of blockchain technology, decentralized

tariff setting algorithms, and Pngme's digital footprint-based credit

assessment creates an open and transparent loan market where borrowers can

obtain cheap capital and investors can access alpha.Pngme also provides a

feature needed to assess their customers' scores and increase capital by

issuing digital bonds that are sold in the lending market to investors. With a

target to close the financial gap of $ 5.2 trillion dollars that will affect

200 million MSMEs globally. Of course, in order to encourage sustainable

economic growth in order to increase opportunities and quality of life.

Why do people have to use Pngme?

As explained earlier, Pngme is trying to

build a decentralized loan market using an integrated blockchain infrastructure

layer. The Pngme platform matches lenders with borrowers using a matching

algorithm that presents loans to lenders based on property risk assessments and

digital credit scores. Risk metadata is added to the digital bond before it is

offered for sale in the lending market. In the first version of the platform

each borrower included bonds consisting of one or many loans Bonds have upper

and lower coupon rates set by the borrower and are guaranteed with a hybrid

credit score model that uses information Existing credit bureaus (if available)

combined with Pngme digital credit scores. Loans in bonds may be further

secured by liquid digital assets to protect bond buyers from standard

borrowers. The lender bids a digital bond through a reverse Dutch auction until

all bids add up to the full par value of the digital bond. The coupon rate for

the bond and hence the April borrower is then determined by the bidder who

clears the auction for the digital bond. This process ensures that credit

interest rates are set efficiently by market lenders, not by a single entity or

a small group of entities

The use of the blockchain will later

ensure an undeniable audit trail of transactions and repayments, while reducing

cross-border settlement costs. The use of programmable smart contracts allows

digital assets to guarantee loans and escrow-based foreign exchange contracts

to make currency exchanges using local fiat currencies and USD protected by

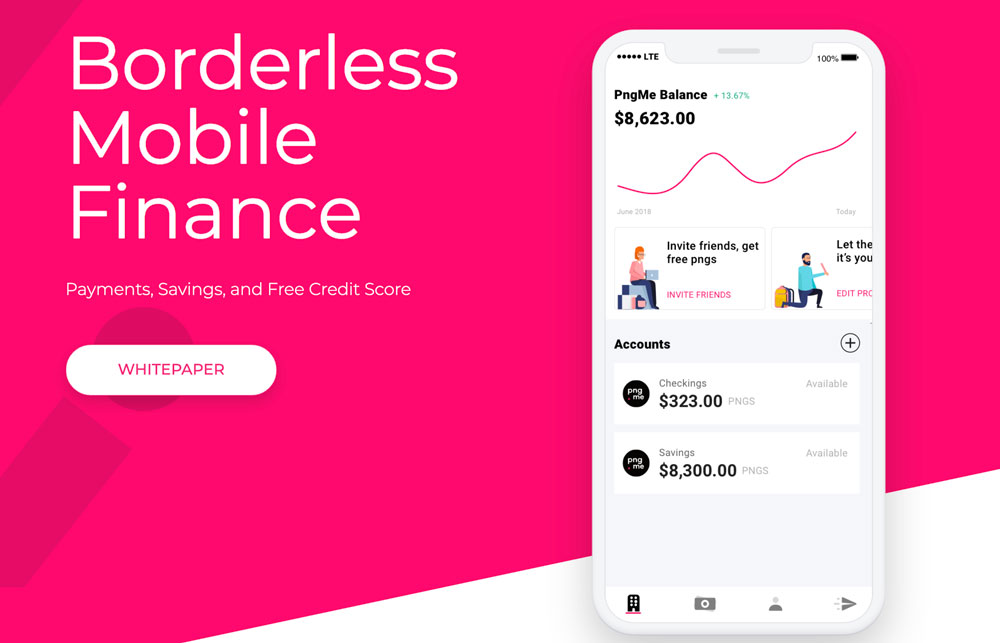

stable, supported coins. In addition to this process, the first mobile

financial platform that connects MSMEs in developing markets with cheap credit

and is easily accessed through innovative white and gray label technologies.

MFIs and Cellular Money Networks use the Pngme mobile app to reduce the cost of

loans to start operations and forward them as savings for their customers. In

addition, MFI customers are empowered with mobile applications such as banking

that facilitate low-cost peer-to-peer payments, savings accounts, and digital

trace-based credit scores.

Pngcoin token economics review

Pngcoin will be the original token of the

Pngme Network and will be generated and issued by Andromeda Technologies Ltd, a company incorporated in Cayman Island. Pngcoin has been

designed for use by two main stakeholders: application users and network

validators. This token model is designed to seed Pngme with Pngcoin according

to user adoption, thus defining liquidity tokens as a function of network

growth - the faster the growth of users on the network, the faster the Pngcoin token economy expands. Users can get tokens by registering to the Pngme mobile

app, risking Pngcoin in their savings account, referring friends, or buying it

through secondary markets.

There will be no initial public sale of Pngcoin to investors or token buyers. However, Andromeda Technologies Ltd will

be able to sell Pngcoin which is unlocked from its cash through token grants,

personal sales or IEO, to finance the development, marketing and growth of the Pngme Network. Pngcoin will then function as a discount utility token for

application users who are risking Pngcoin as a member. Users will be entitled

to special discounts in the Pngme ecosystem, such as peer-to-peer payment

transaction fees made from within the Pngme mobile application.

Conclusion

From the discussion above, Pngme tries to

provide a solution by creating a global lending market platform that provides

access to an alternative lending asset class. With the support of blockchain

technology, decentralized rate setting algorithms and digital footprint-based

credit assessment with the aim of creating a loan market open and transparent.

With the support of Pngcoin which is designed to seed Pngme with Pngcoin according to user adoption, thus defining liquidity tokens as a function of

network growth.

Website : https://pngme.com/

Telegram Chat: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook: https://www.facebook.com/pngme/

Medium: https://medium.com/pngme

Instagram: https://www.instagram.com/

Reddit: https://www.reddit.com/r/pngme/

LinkedIn: https://www.linkedin.com/company/35697946

YouTube: https://www.youtube.com/channel/UCmUPIgu-xfdYijOS7eOwYyg

BitcoinTalk ANN: https://bitcointalk.org/index.php?topic=5140127

Twitter: https://twitter.com/pngmemobile

Facebook: https://www.facebook.com/pngme/

Medium: https://medium.com/pngme

Instagram: https://www.instagram.com/

Reddit: https://www.reddit.com/r/pngme/

LinkedIn: https://www.linkedin.com/company/35697946

YouTube: https://www.youtube.com/channel/UCmUPIgu-xfdYijOS7eOwYyg

BitcoinTalk ANN: https://bitcointalk.org/index.php?topic=5140127

By

My Bitcointalk Link : https://bitcointalk.org/index.php?action=profile;u=1305012

My ETH Address :

0xCC028E8465c39c8B5D250431c82239dc7EE48a6d

0 komentar: